Take control of your investments with HSBC Invest. As a global leader in banking and wealth management, our platform seamlessly integrates your trading with your day-to-day banking. It's never been easier to build and manage your portfolio.

All-in-one platform

There's no more need for multiple usernames and passwords. Now you can manage your banking and your portfolio with a single sign-on.

- Access shares, exchange traded funds (ETFs) and managed funds all in one place

- No-fee platform – you only pay when you trade

- Make a trade in as little as 3 clicks

- Trade from your linked HSBC transaction account

- Your investments are held in your name with CHESS

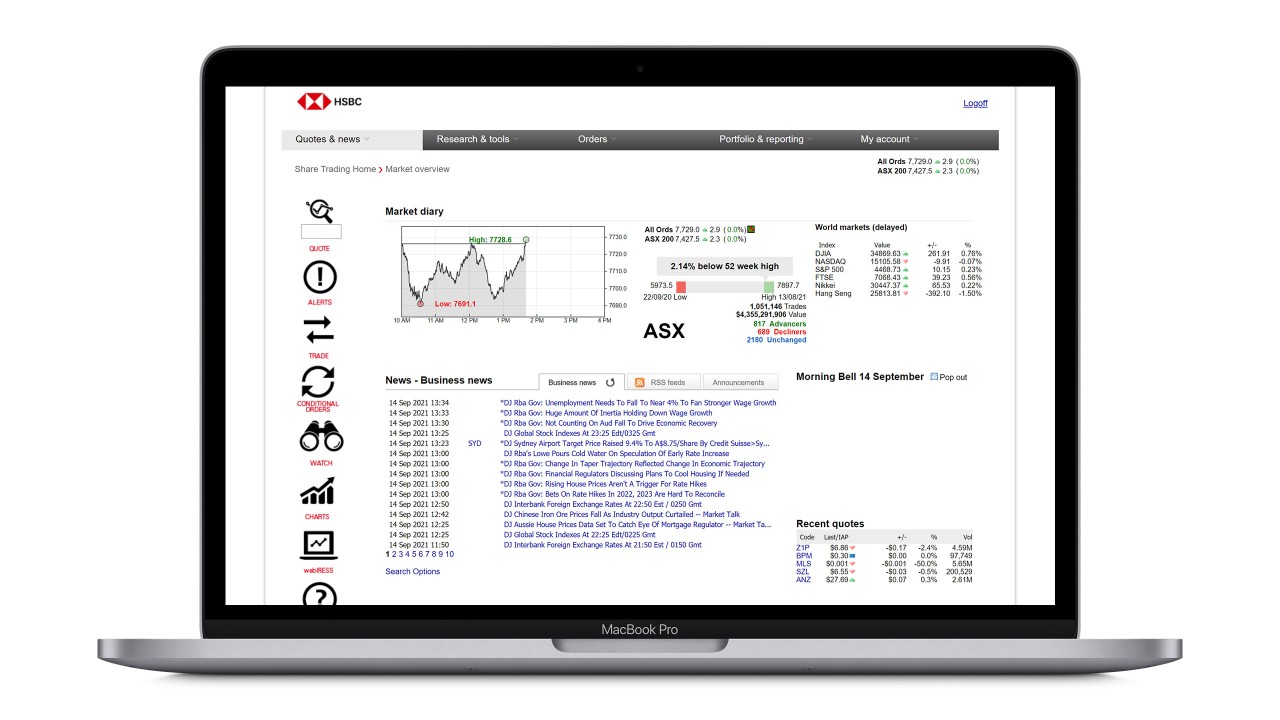

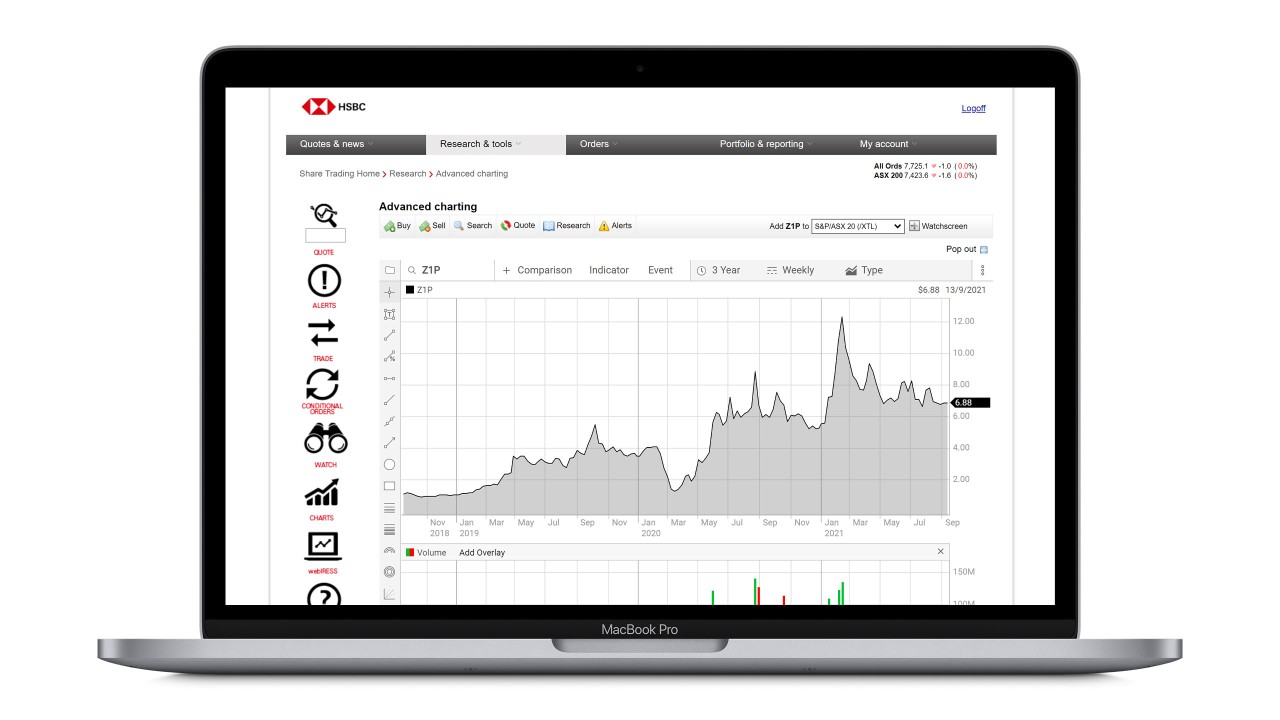

Complimentary research, insights & tools

Stay up to date on the latest market developments and take advantage of opportunities as they arise.

- Trading alerts & tools such as charts and market maps

- Unlimited stop loss and advanced conditional orders

- Access to broker research reports

- Get the latest market news & announcements, personalised to your watch list & portfolio

- Upgrade option for live date feeds

Invest on the go

Access the latest news and trading tools with our feature-rich trading app, so you can make faster, smarter trades wherever you are in the world.

- Easy-to-use interface, optimised for one-hand functionality

- Log on using fingerprint or facial recognition

- Suitable for all levels of experience

- No setup costs or monthly fees

- See the balance of your linked HSBC account, updated in real time

Download the app

Fees and charges

These tables summarise the fees and charges that apply to different types of investments and investment services with HSBC Invest.

You might also be interested in

Shares

Whether you are a new or experienced share trader, build your share portfolio with easy access to over 2,000 ASX listed companies, plus set up complimentary alerts and watch lists so you don't miss a trade.

Exchange Traded Funds

Exchange-traded funds (ETFs) track market indexes on large cross sections of asset classes and styles, and with over 200 to choose from, they're the easy way to give yourself exposure to your market view.

Bonds

Looking to diversify into investment grade bonds? Enjoy online access to exchange traded corporate and government bonds.